Lower-income NTUC union members can get up to $120 in e-vouchers

To qualify for the programme, applicants must be NTUC members with at least six continuous months of membership as at their application date, with no outstanding membership payments due.

MAS keeps Singapore dollar policy unchanged amid US tariff risks to economy

“Our 2025 and 2026 GDP growth forecasts for Singapore currently stand at 2.1 per cent and 2.5 per cent respectively, but the caveat is that US tariffs may have irrevocably shifted global economic dynamics.”

UOB to trim deposit rates on flagship account from Sept 1 after OCBC cut; DBS stays unchanged

The affected categories are: Card spend and the requirement to make three debit transactions via Giro; and card spend and salary credit.

Trump modifies reciprocal tariffs ahead of deadline; rate on Singapore remains at 10%

Most of the tariffs will take effect after midnight on Aug 7, to allow time for US Customs and Border Protection to make the necessary changes to collect the levies.

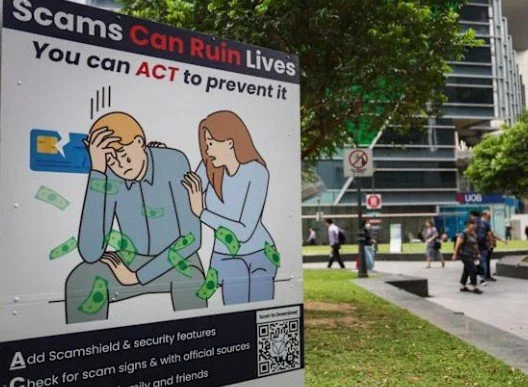

More than $1.7 million lost in scams using fraudulent mobile apps

Victims were told to download and set up accounts on fraudulent mobile apps such as Dyreka, M Tree PE, Saftools and Tik StoreB2B.

Economists split on Singapore monetary policy after surprise growth

It adjusts policy via three levers: the slope, mid-point and width of the policy band. Maybank economists expect MAS to maintain policy given the improved economic outlook.

GIC posts 3.8% annualised real return over 20 years despite economic uncertainties

Without adjusting for inflation, GIC’s annualised return came in at 5.7 per cent over the same 20-year period. This is expressed in US dollars.

US companies, consumers are paying for Trump’s tariffs, not foreign firms

Import prices excluding fuel were up notably in June, suggesting foreign companies are not shouldering the burden by offering US firms lower prices – challenging the President’s claims that other countries pay the rate.

New Silk Road, one of Singapore’s longest-running hedge funds, shuts after US investor pullback

The firm, started by two finance veterans about 16 years ago, saw assets under management plummet to US$615 million (S$787 million) as at December 2024, from almost US$2 billion as recently as 2021.

MAS appoints first 3 asset managers to inject initial S$1.1 billion into Singapore equities

Temasek-backed Fullerton Fund Management will be among the first of three asset managers to tap a S$5 billion investment fund initiative announced by authorities earlier this year.

New digital tool in Singapore to encourage advance care planning

Called myACP, the tool allows users to document their preferences for medical treatment in advance, in line with their personal goals and values.

Tokenize Xchange to exit Singapore after being denied digital payment token licence

This comes after the Monetary Authority of Singapore (MAS) decided not to grant the company a licence to offer digital payment token services,